- #Quickbooks for personal use instead of quicken software

- #Quickbooks for personal use instead of quicken download

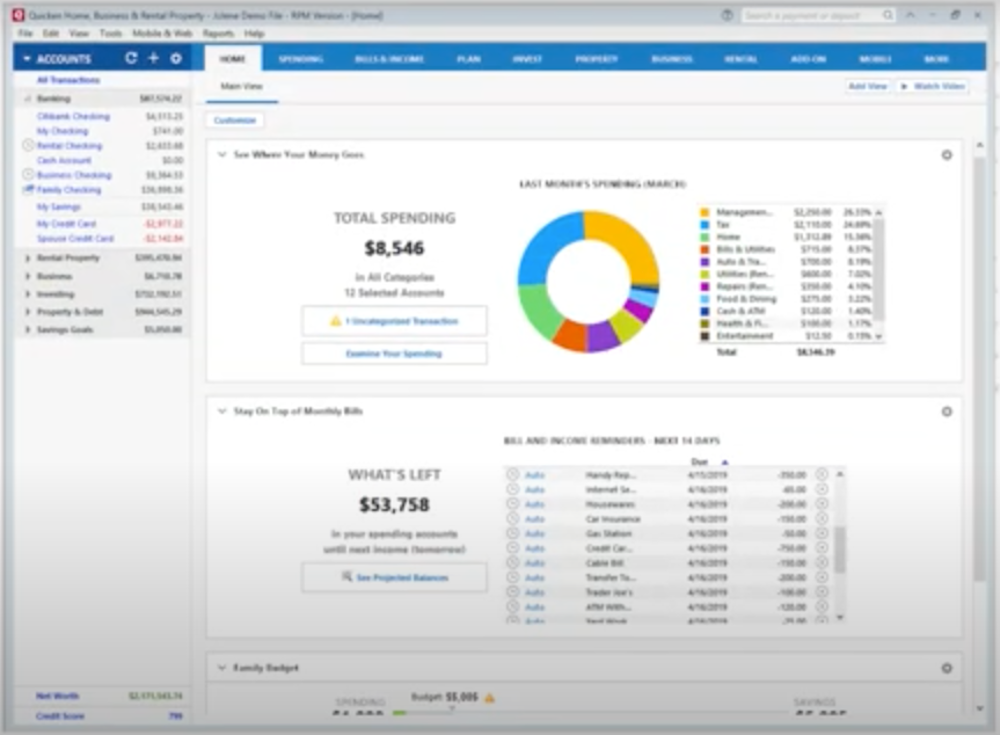

Start Tracking Today!Ĭreating a budget should be an essential part of everyone’s financial plan, and budgeting software is excellent to track where your money is going and how much you’re managing to save. With Empower, you can see your net worth, analyze investments, and discover any hidden fees you weren’t aware of before – as well as set spending and saving goals. If you have an extensive portfolio (worth $100,000 or more), you can pay a fee to receive personalized advice from financial experts. You can track whether you’re in line with investment goals such as retirement, check how well your portfolio is performing, and find out if you’re paying unnecessary fees. Unlike most budgeting software, the options for monitoring your investment accounts are more specialized. Personal Capital helps you analyze your money, track your investment portfolio, monitor your net worth, and also track your credit score. Just as with budgeting software, you can connect each financial institution you have an account with and view everything in one place. Personal Capital offers a way to track your investments alongside your other accounts within a single money dashboard. Upgrading to deluxe will give you more customization, and the premier will provide you with more help with investments, taxes, and savings. If all you want to do is track your finances, then the starter pack will suffice, but if you want to perform more sophisticated functions, then it might be worth investing. Quicken Home & Business: $8.99/month ($107.88 billed annually).Quicken Premier: $5.99/month ($71.88 billed annually).Quicken Deluxe: $3.99/month ($47.88 billed annually).Quicken Starter: $3.49/month ($41.88 billed annually).You can choose between the following plans: You’ll be able to do everything from calculating your net worth to paying your bills automatically. If you want to be able to handle your investments, taxes, and budgeting in one app, then you can’t get much better than Quicken. Quicken is one of the most established pieces of personal finance software for a good reason. Otherwise, an all-purpose program can be very effective. If you’re looking for the most sophisticated advice and learning content, then you’d be better off with more specialized software. There are a few personal finance programs that cover a couple of areas, but there aren’t many that are suitable for absolutely everything. RocketMoney: Best Bill Management Software.FutureAdvisor: Best Investging Software.Buddi: Best for Personal Finance Beginners.Mvelopes: Best for Zero-Based Budgeting.Personal Capital: Best Investment Tracker.Quicken: Best Overall Financial Software.In This Article 10 Best Personal Finance Software Options

Skip down to see all the best personal finance software options Skip to the best option for your financial needs: Possible uses include budgeting, saving, investing, taxes, and bill management. To narrow down the best software for your needs, you have to ask yourself what you most need – personal finance is a broad term. Yet new pieces of financial software are constantly being released it can be overwhelming to choose just one. Tracking your budget can now be automated, you can learn basic principles directly from your phone, and you can consult with advisors virtually for a lower price tag.

#Quickbooks for personal use instead of quicken download

You can simply download an app or piece of computer software that will do the work for you. In the digital era, it’s never been easier to stay in control of your finances. Today, we are blessed with many different personal finance software options to make money management easier and faster. In the past, managing your finances meant manually recording your income and expenses, doing the calculations yourself, and having consultations with professionals.

0 kommentar(er)

0 kommentar(er)